Cross Border Payment: How to use Wire Transfer using Chase Bank

We understand that cross-border transactions in volume have high transaction fees for current retail-tailored payment gateways like PayPal, Stripe, etc. For transactions more than $13000 USD, we recommend our customers go through your online or local bank account in the country you are residing and initiate a wire transfer.

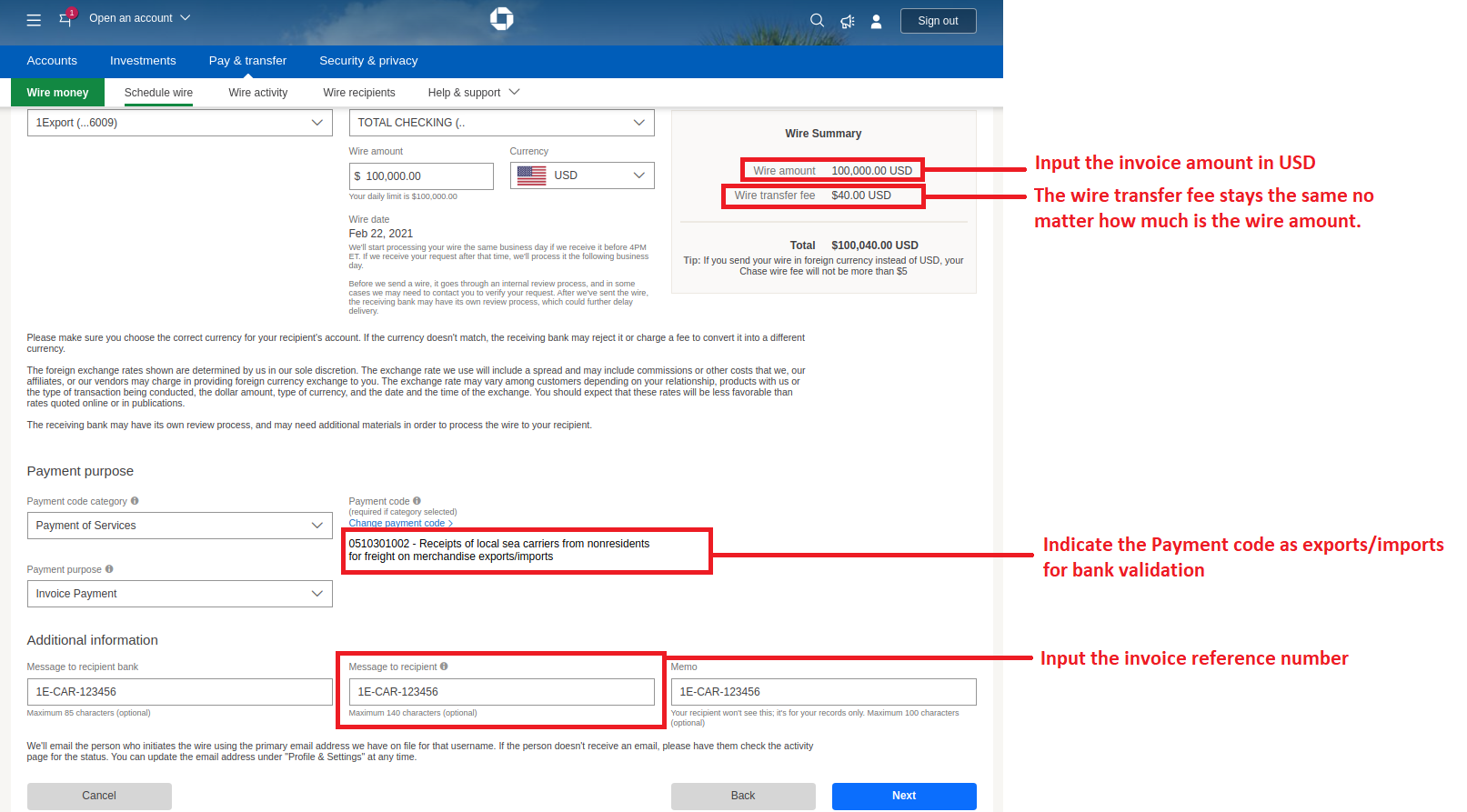

The benefit of going the route of wire transfer is that the transfer fee is constant no matter the volume.

On your Chase Account you can navigate under the “Pay & Transfer” Tab and schedule a wire.

- Go to Pay & Transfer Tab

- Choose Recipient. If you have not done so already, you can create one easily so that it can reflect as an option. Message us to get our bank details.

- Input the invoice amount in USD

- Fill in the Payment purpose section

- Make sure to indicate that this transaction is for exports/import for bank validation

- Fill it in as an Invoice Payment

- Fill in the Message as the Invoice reference number for bank validation and tracking

- Click Next and it should be on its way to us within 2-7 days.

Have a Wells Fargo Bank? You can learn how to wire transfer using a Wells Fargo Bank here.