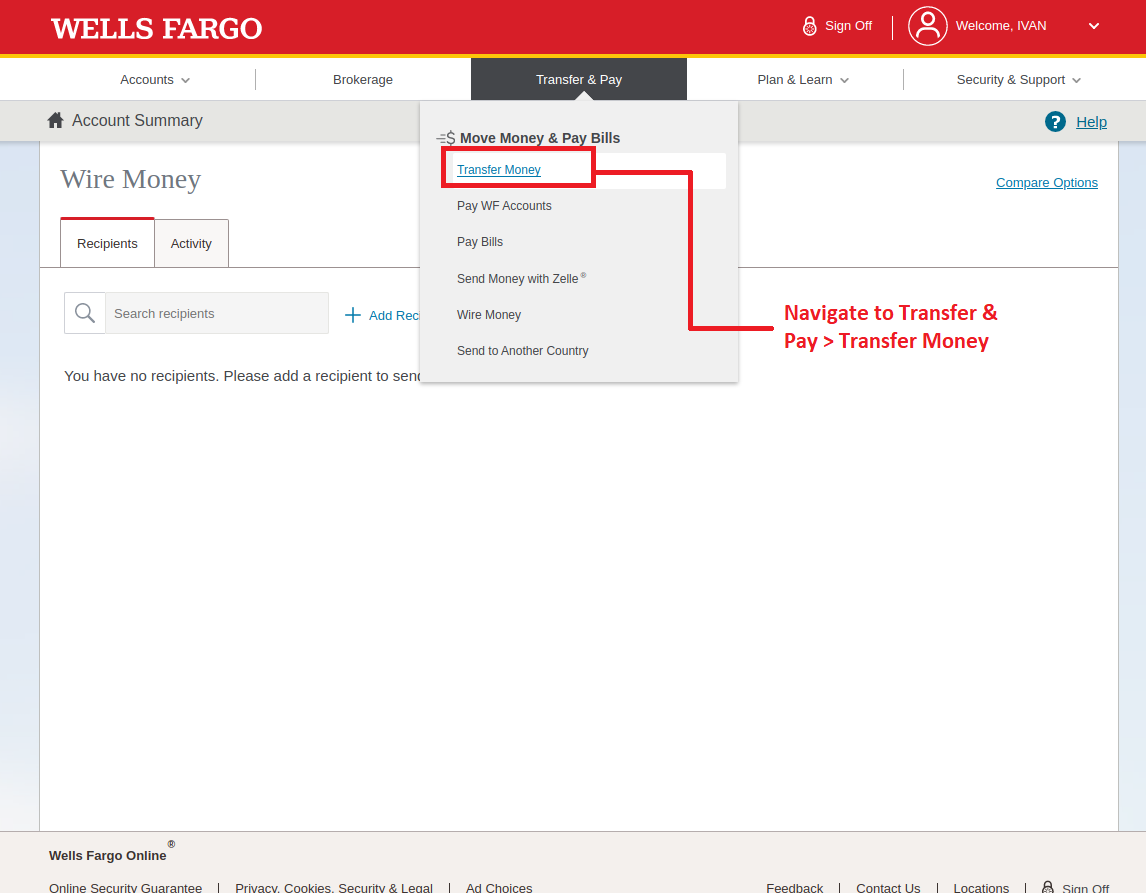

Cross Border Payment: How to use Wire Transfer using Wells Fargo bank

On your Wells Fargo Account you can navigate under the “Transfer & Pay” Tab and transfer money.

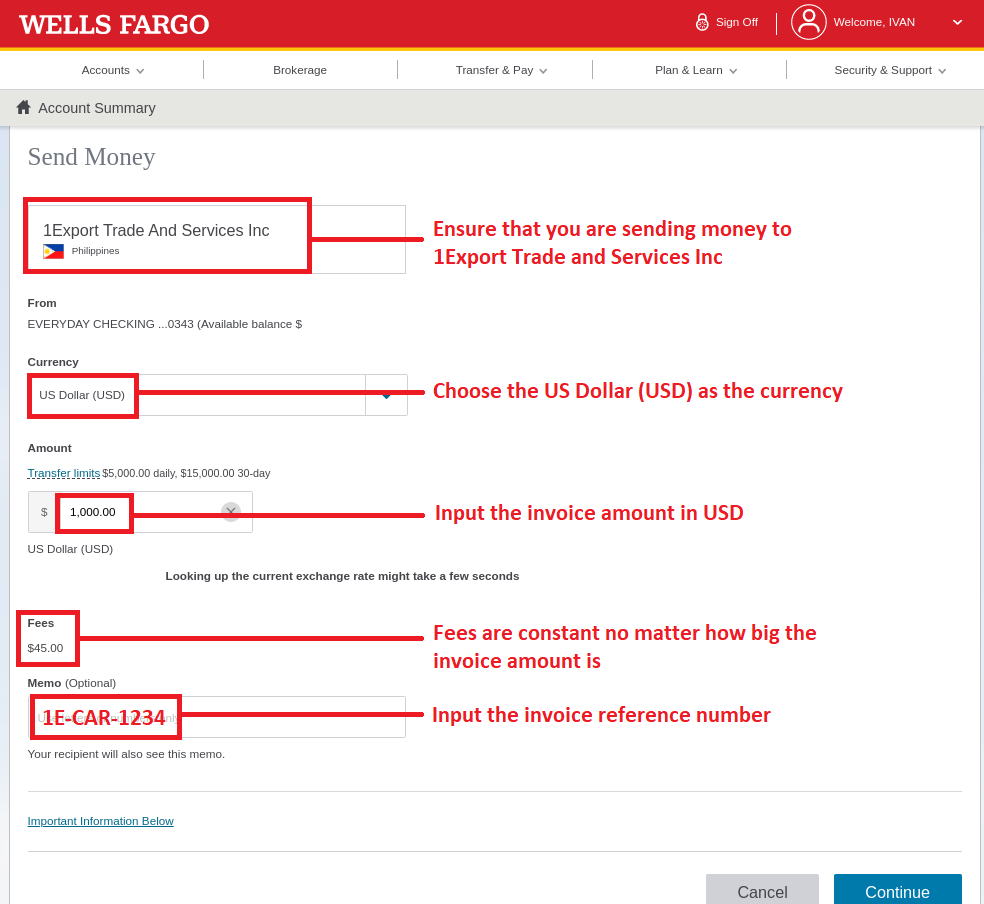

We understand that cross-border transactions in volume have high transaction fees for current retail-tailored payment gateways like PayPal, Stripe, etc. For transactions more than $13000 USD, we recommend our customers go through your online or local bank account in the country you are residing and initiate a wire transfer.

The benefit of going the route of wire transfer is that the transfer fee is constant no matter the volume.

- Navigate on Transfer & Pay

- Click on Transfer Money

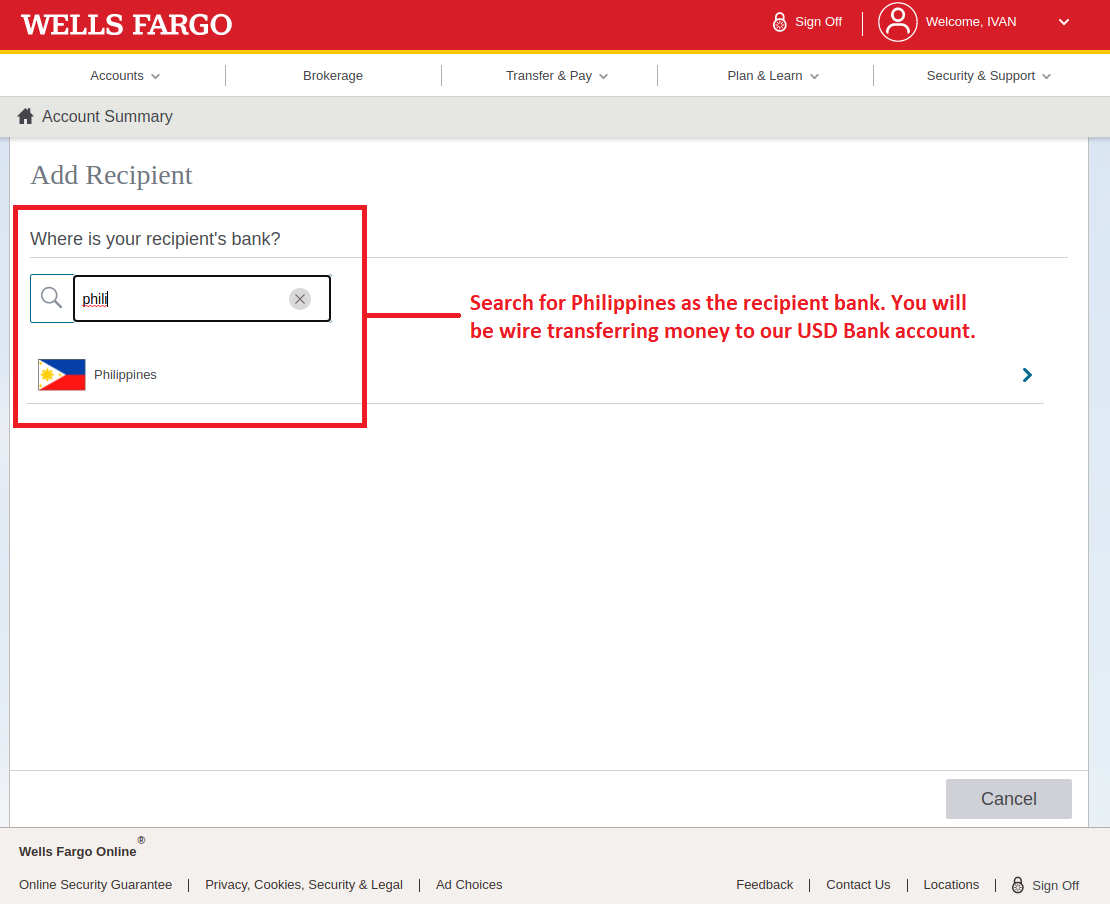

- Add Recipient by locating the recipient country, for our case it is Philippines

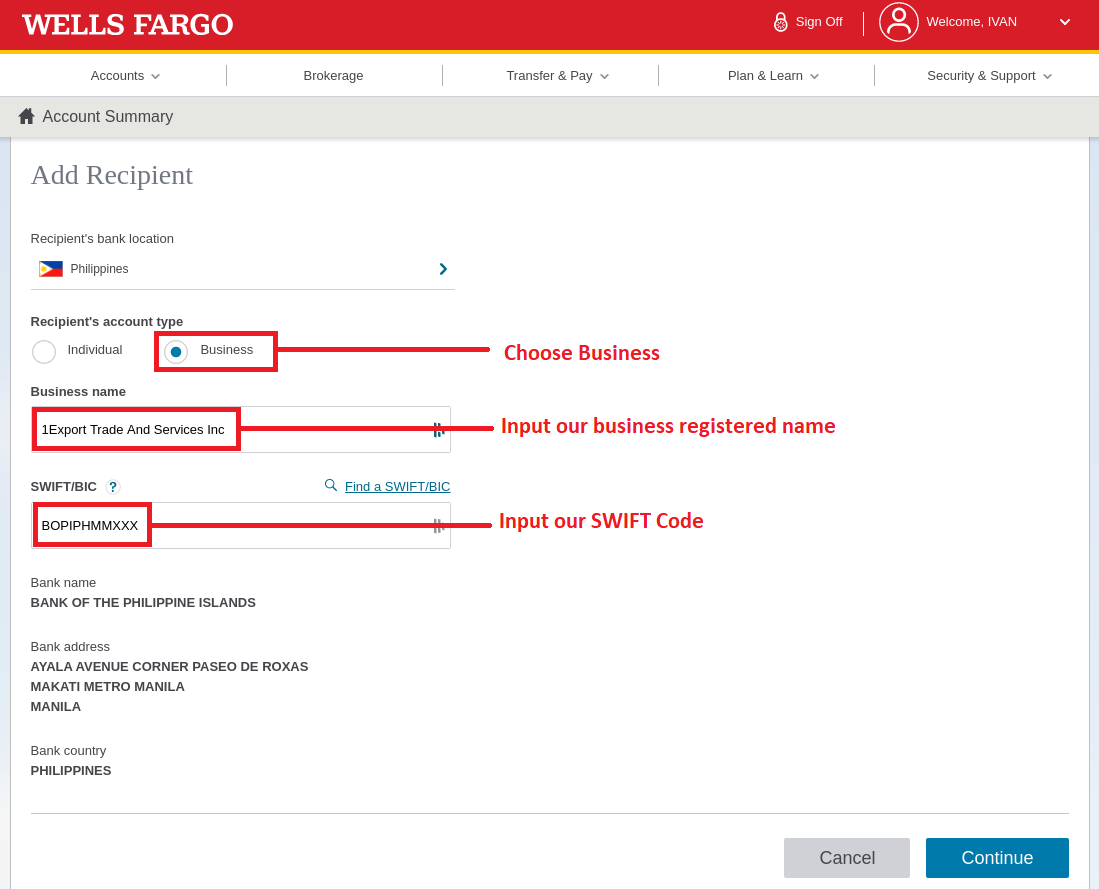

- For the account type, choose Business. You may message us for detailed bank details.

- Fill in our company registered name

- Fill in our Bank’s SWIFT code

- On the Send Money, ensure that you are sending the money to the correct registered business name

- Set the amount currency in USD

- Input the invoice amount in USD

- On the memo, fill in the invoice reference number for bank validation and tracking

-

Click continue and finish it. It should be on its way to your recipient within 2-7 days.

Have a Chase Bank? You can learn how to wire transfer using Chase Bank here.