Cross-border payment 2021 options

Domestic real time transactions are getting better by the day. In the Philippines we have Coins.ph, Gcash and in the US we have Venmo, Gpay, etc. but on a cross-border level we have SWIFT but it is not as SWIFT as it is. In a cross-border setting, it is hard to move money across different countries.

Recipients need to wait for about 2-14 days before it reflects to their local bank accounts. Online payment gateways are taking in 3-7% transaction fee for technology infrastructure and operations costs powering it. This, among other things (like COGS, Logistics) must be factored in when pricing cross-border services or products.

We understand that cross-border transactions in volume have high transaction fees for current retail-tailored payment gateways like PayPal, Stripe, etc. For transactions more than $13000 USD, we recommend our customers go through your online or local bank account in the country you are residing and initiate a wire transfer.

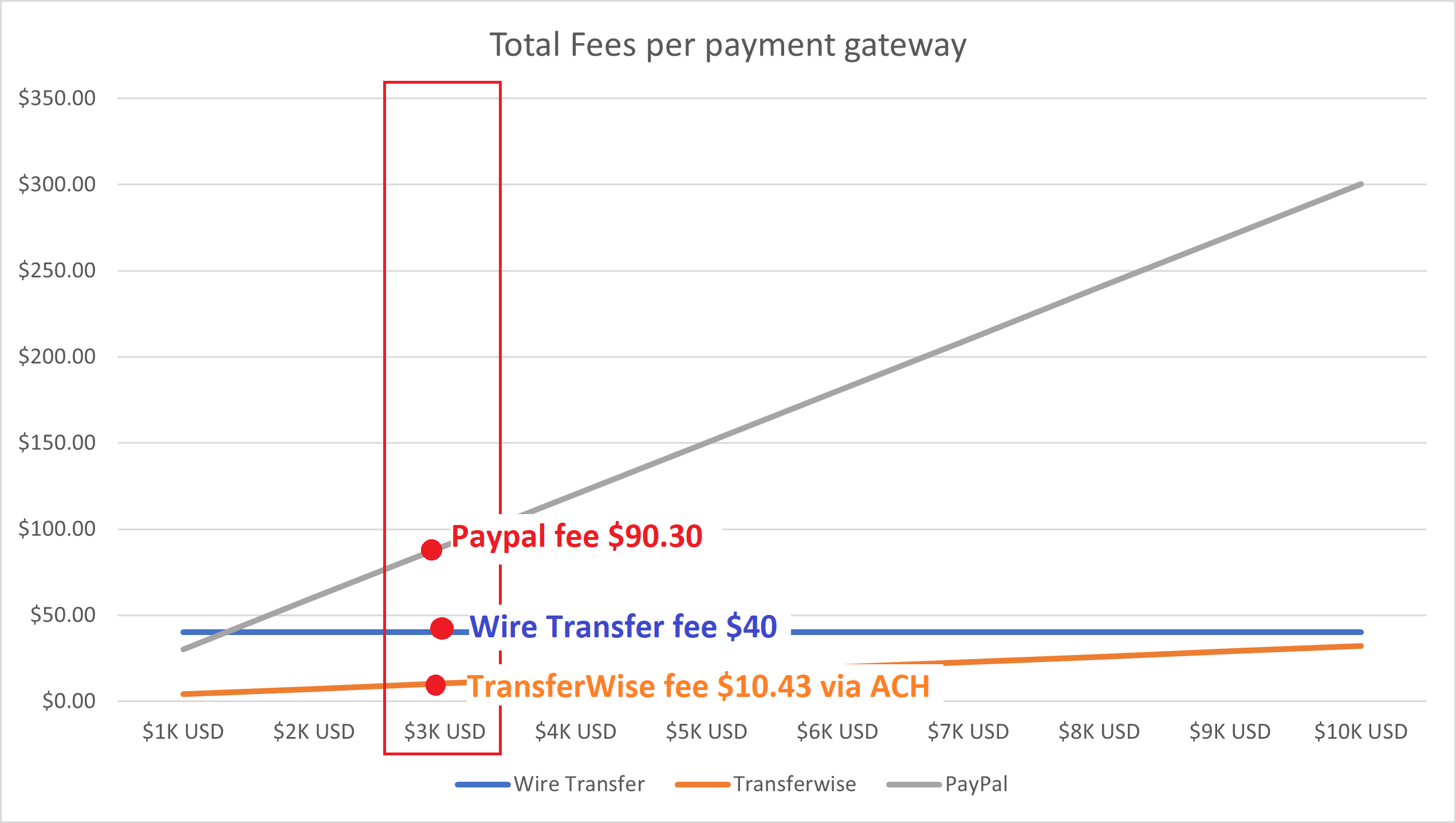

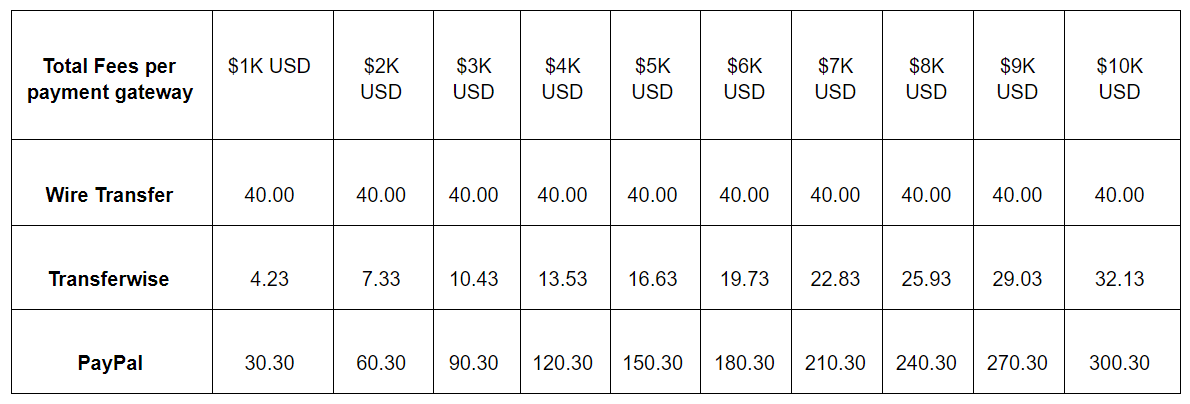

The benefit of going the route of wire transfer is that the transfer fee is constant no matter the volume. As an example, our customer in the United States got an invoice of $3000 USD and she will need to pay us for the products and services she is availing from us at caravan.1export.net .

For her specific use case, the best fitting payment gateway is Transferwise. To send a $3000 USD she would just need a fee of $10.43 vs PayPal's $90.30 and the constant fee of wire transfer’s $40. But do note that this method is Transferwise via ACH meaning your money needs to be already in your account and will be wired instantly. We’ve had customers that wanted to use their credit card because they don’t have that liquid money yet, therefore you have a different use case and different costing. But I would bank on Transferwise still being the cheapest way in terms of volume.

Looking at the graph, Transferwise is still a fit for about $13k but if it’s going to be more than that, we would go for wire transfer. Us at 1Export, where our ticket sizes are in the range of $20k++ because we export by the containers we go the route of wire transfer or telegraphic transfers.

There’s a lot to improve in this space and we are excited to be in this position to have experienced this problem alongside us trying to improve cross-border trade for the Philippines to the United States or even globally.

Looking into sending money through wire transfer? See our posts about Chase and Wells Fargo wire transfers.